Topeka Business Hall of Fame | Mark Yardley

Photos by JEFF CARSON & JENNIFER GOETZ

When we hear the stories of the men and women being inducted into the Junior Achievement Topeka Business Hall of Fame, we expect to learn about their road to success and the generosity with which they give back to the community.

The same is true for Mark Yardley, who has enjoyed a storied career at Federal Home Loan Bank. But you might be surprised to learn that his business acumen began long before he entered the world of banking, and that his first business often left him with dirt on his hands — literally.

“My job as a kid was catching nightcrawlers. I charged 25 cents per dozen,” Mark said. “I lived on Twiss Avenue, and since most of the Santa Fe shop people lived in North Topeka, they had to go down Twiss to get to the Sardou bridge. Many of them would stop and buy nightcrawlers from me on their way home.”

Mark put a sign out in front of his house to market his business, and if someone stopped by when he was at school, his mother would handle the transaction. Mark said that was his first experience handling money. The agreement was that he would put half in savings and the other half he could spend. Mark may be the only person in Topeka who can claim he paid for college with worms.

“I had enough worm money put away in savings that I used it to buy my wife’s engagement ring, as well as a down payment on our first house,” Mark said.

That ability to manage money would serve Mark well in his banking career.

ALL ABOUT THE NUMBERS

Mark always knew he wanted to be an accountant because he wanted to follow in his father’s footsteps. After graduating summa cum laude from Washburn University with a business administration degree with an emphasis in accounting, Mark decided to take his accounting expertise to the next level. When it was time for Mark to sit for the Certified Public Accountant exam, his father accompanied him and took the exam at the same time.

“Dad didn’t pass the CPA,” Mark said. “But he was certainly proud when I did.”

Mark’s first job out of college was in Topeka with the national public accounting firm in Topeka, Fox & Co., now the local firm of Wendling, Noe, Nelson & Johnson. As a public accountant, he spent seven years learning the intricacies of the audit side of accounting.

“I had offers to work at one of the big firms in Kansas City,” Mark said. “But I didn’t want to leave Topeka. I grew up here, my wife was from here, our families were here, and I really liked Topeka — still do.”

While he enjoyed his position at the public accounting firm, the auditing responsibilities meant he was traveling all the time. With a 5-year-old and a 2-year-old at home, Mark decided he needed to make a change.

“That last year at the firm I was away from home more than 80 nights,” Mark said. “That is hard on a family with two small kids and a wife working part time.”

A CAREER BY THE NUMBERS

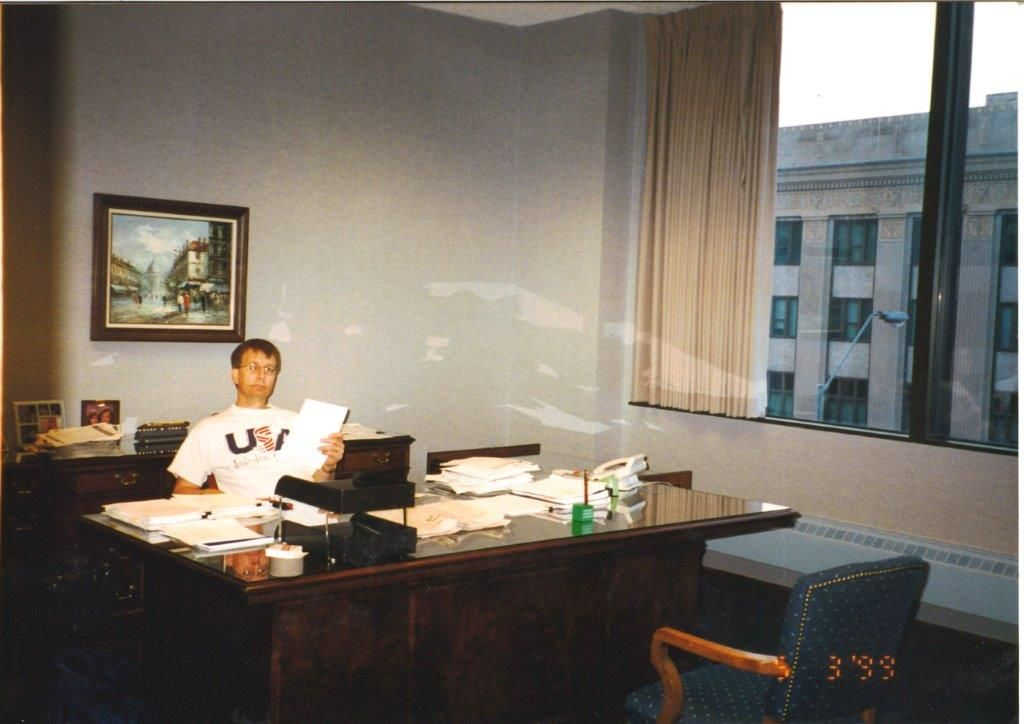

Mark joined FHLBank Topeka as director of internal audit in 1984 and spent the remainder of his career holding various positions within the bank. During his almost 40 years at FHLBank, Mark served as director of internal audit, chief financial officer, executive vice president, chief risk officer and, ultimately, as president and chief executive officer beginning in 2017.

“Starting out in the internal auditing department allowed me to learn about all aspects of the bank,” Mark said. “When you are looking at everyone’s numbers, you get a better understanding of how each department operates.”

Mark spent 14 years managing the internal audit department, growing it from a two-person team to a staff of eight. Then one day, the chief operating officer approached him to ask if he would take over the role of chief financial officer. Mark’s response was, “Sure.” He held that position for eight years.

As the complexities of the banking industry multiplied and the industry experienced significantly more risk, Mark’s role shifted from CFO to that of chief risk officer, which he held for nine years.

Then in 2017, the FHLBank’s board of directors asked him to become president and CEO.

“When they first asked me, I told them no,” Mark said. “I agreed to take the position on an interim basis, but I would not agree to a long-term commitment because of my age at the time. I always thought I would retire early.”

The directors wouldn’t take no for an answer. The parties agreed to a minimum three-year commitment, which ultimately turned into seven.

“The bank is such a good place to work, with such great people that it never seemed the right time to leave,” Mark said.

COMPLEX MATH

The banking industry has undergone significant shifts over the years as a result of increased regulation, evolving technology and derivative accounting. Mark helped FHLBank navigate those changes and come out stronger on the other side.

“We transact a lot of derivatives, we trade on Wall Street, we buy a lot of mortgage-backed securities, we buy mortgages from our members,” Mark said. “All of those components bring about their own type of complexity.”

Mark said he can see his fingerprint on the bank, starting from when he first became chief financial officer. At that time, other FHLBanks were creating mortgage programs in which they would buy mortgages from their members. His first task as CFO was to evaluate these mortgage programs implemented by other FHLBanks, then take that knowledge to create a similar program at FHLBank Topeka. Mark selected and started FHLBank’s Mortgage Partnership Finance — a mortgage program developed and operated by FHLBank of Chicago that not only helped the FHLBank Topeka see significant growth, but also added an extra layer of complexity to the bank’s operations and reporting.

During that same period of time, FHLBank Topeka was required to create its own capital plan. Once again, Mark dove into the new challenge, conducting research, designing and writing the capital plan.

Shortly after developing and implementing its capital plan, FHLBank registered with the SEC. The registration process involved filing a practice Form 10-K and attending regular meetings with SEC personnel, once again making the FHLBank’s reporting even more complex.

“When we registered with the SEC, we actually had to teach them about derivative accounting,” Mark said. “As this accounting method was relatively new and something you have to learn by doing, we helped walked them through methodology and intricacies of hedge accounting utilizing derivatives.”

Even with the added complexity and increasing regulatory requirements, Mark said he approached these new challenges with enthusiasm because he viewed them as something to keep him interested and engaged rather than an obstacle to be overcome.

“I felt like we were constantly doing something new and challenging,” Mark said. “With each growth phase, I was able to learn something new, to push my limits a little. When I started at FHLBank as an internal auditor, I wrote the financial statements, and they would be 12-14 pages long. Now, our financial statements are 50 plus pages long and our SEC report is over 100 pages long.”

TAKING ACCOUNT

Looking back over his career, Mark takes the most pride in the role he has played over the years in bringing the bank to where it is today. With every position he held, Mark helped navigate the bank through periods of growth as well as turbulent financial times, including the financial crisis of 2007/2008.

Mark is also proud of the team he’s had the privilege to lead, which has grown to more than 260 employees under his watch.

“My goal has always been to be that stable ship that will be able to weather any storm,” Mark said. “But every ship needs a trustworthy crew to stay afloat. At FHLBank, I couldn’t have asked for a better crew.”

Officially retired February 1, Mark is the only person in FHLBank System history to begin in the internal audit department and end up as president of an FHLBank. Having spent nearly 40 years with the same company, he admits that it is difficult to say goodbye.

“I will be honest, we have some things on our plate that I would like to be around for,” Mark said. “But I have already stayed longer than I planned, and it is time for me to be done.”

Mark said knowing that he is leaving the bank in good hands makes it a little easier to shut the door on that chapter of his life.

ADDING IT ALL UP

Throughout his career, Mark has served on numerous boards and committees. He is a member of the Kansas Society of Certified Public Accountants and the American Institute of Certified Public Accountants. He joined the Washburn University Foundation board of trustees in 2014, became a director in 2015, and has served as chair of the audit committee and as part of the executive committee. Mark has served as treasurer of the Greater Topeka Partnership since its inception in 2018. He has also held the position of treasurer for Topeka Bible Church for more than 30 years.

“My wife calls me a perpetual volunteer,” Mark said.

In addition to the numerous boards he has served on, Mark volunteered for other organizations dear to his heart. He was a member of Quail Unlimited and helped plan banquets and other events. He coached his son’s baseball team for several years and served as president of the Shawnee County Amateur Baseball Association.

As he goes into retirement, Mark plans to reduce some of his other commitments.

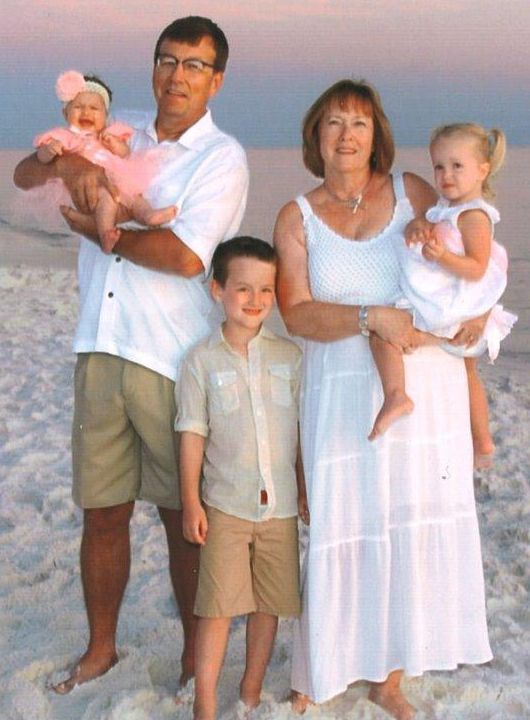

“I am excited to spend time with my lovely bride,” Mark said.

Mark and his wife, Sheree, started dating their senior year in high school and have been married for 49 years.

Mark also plans to spend more time with his second love: rebuilding cars. While he won’t say exactly how many cars he has, he admits to owning six Studebakers, the oldest being a 1955 President. His current project is a 1956 Studebaker Power Hawk.

“I have lots of cars,” Mark said. “I probably need to get rid of some, but that is harder than it sounds.”

One task Mark refuses to give up during retirement is taking his grandchildren to school every day, which, right now, entails carpooling with an eighth grader, a fourth grader and a second grader.

“I started taking the first one to school when he was in kindergarten,” Mark said. “Now he is in eighth grade. But even once he starts driving, I still have a few years to go with the littler ones.”

Mark and Sheree have a total of six grandchildren — three in Topeka and three in Kansas City.

Mark, who was born in Topeka, is proud to call the city home. Raised in the Oakland neighborhood and a graduate of Highland Park High School and Washburn University, Mark embodies what it means to support your hometown. He and Sheree have given generously to Washburn University, establishing business scholarships and donating to the student emergency fund, softball field improvement project, the Welcome Center, the Indoor Athletic Facility and the School of Business Dean’s Fund for Excellence.

They also support local theater and the arts (Mark sang with the Scots Singers in high school). Mark said he has been blessed by the love and support that the community has shown him his whole life and wants to pay that forward.

“Topeka is small enough that you know people, but big enough to always find things to do,” Mark said. “This is the best place in America to raise a family and grow old.”