Kansas Economic Performance

Manaf Sellak, Ph.D.

Assistant Professor of Economicst

Washburn University School of Business

Source: Bureau of Economic Analysis

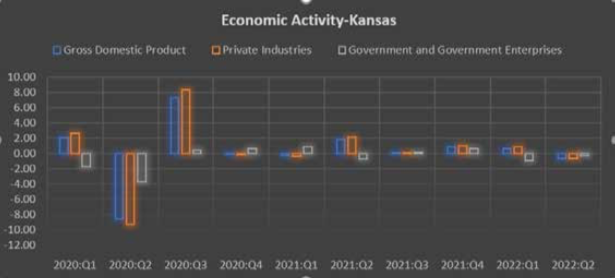

FLUCTUATIONS IN ECONOMIC ACTIVITY

Gross domestic product (GDP) is the broadest measure of economic activity. In Kansas, economic activity generated by private industries and government enterprises has fluctuated during the last two years.

The pandemic shock in the second quarter of 2020 reduced private industries’ output by 8.59% and government enterprises’ output by 9.29%.

After a series of federal and state fiscal stimulus programs, which boosted consumer spending and business investments, economic activity recovered to its pre-pandemic level in the second quarter of 2021 with a GDP growth of 2.09%.

However, higher prices of inputs and commodities caused by the war in Ukraine slowed economic activity in the first quarter of 2022, with GDP growth of only 0.66%.

In addition, The Federal Reserve Bank’s tight monetary policy, which began in March 2022 to counter higher inflation, put more pressure on Kansas consumers and businesses, leading to a negative GDP growth of -0.63% in the second quarter of 2022.

This negative trend in economic activity is expected to stick around for a short term, given the existence of the global supply shortage and the Fed’s intention to keep raising the interest rate until inflation is back to 2%.

Source: Bureau of Labor Statistics

A TIGHT LABOR MARKET WITH GROWTH IN NOMINAL WAGES

Despite the global supply shortage and the Fed’s tight monetary policy, the labor market in Kansas remains strong. It’s following the national trend, with an unemployment rate below 4% since February 2021 and down to 2.5 % in September 2022.

The tight labor market led to a wage war in which nominal per-capita personal income grew at an average quarterly rate of 1.16% between January 2021 and August 2022. According to the Bureau of Labor Statistics, Kansas’s economy added 31,600 new jobs between January 2021 and June 2022, with an average quarterly growth rate of 0.79% and 0.33% in the manufacturing industry and services, respectively.

However, the recent Fed’s third consecutive 0.75-point rate rise put pressure on the Kansas labor market, leading to a cut of 600 jobs during the third quarter of 2022. This trend will likely continue as the Fed raised rates by 0.5 percentage points at its December meeting.

Nevertheless, easing global supply chain restrictions would lower the overall prices in the economy, which will boost consumer spending, and maintain a stronger labor market in the long run. This would lead to a Fed pivot, a situation in which the central bank reverses its policy and no longer continues raising the interest rate.

Source: Bureau of Labor Statistics

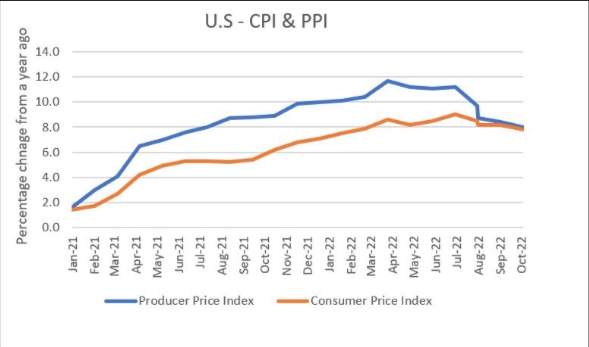

SIGNS OF EASE INFLATION AND BETTER SUPPLY CONDITIONS

The Fed’s expansionary monetary policy during the pandemic and the global supply shortage translated to inflationary pressure on consumers and businesses in Kansas. The U.S. inflation rate, measured by the annual percentage changes in the consumer price index, rose sharply from 1.4% in January 2021 to 9% in June 2022, the highest in four decades.

Even though inflation was at its highest level, the Kansas labor market remained strong, and GDP was still growing but at a slower rate than the pre-pandemic period.

To counter inflation, the Fed raised the interest rate four times, which brought U.S. inflation down to 7.8% last October without hurting the labor market. This is a good sign that the Fed will likely adopt less aggressive policies to combat inflation.

In addition, the producer price index (PPI), which reflects supply conditions in the economy, shows some positive signs. According to the bureau of labor statistics, the PPI climbed by 8% last month, down sharply from the 11.7% increase in March 2021.

These statistics about easing inflation and better supply conditions will likely improve economic activity and maintain a strong labor market in Kansas.