The ABCs of ESG

JAMES WALDEN, CFA

Chief Investment Officer and Partner of Clayton Wealth Partners

On November 22, 2022, the US Department of Labor (DOL) quietly released its final rule regarding the consideration of environmental, social, and governance (ESG) factors by fiduciaries of employee benefit plans. This rule, entitled “Prudence and Loyalty in Selecting Plan Investments and Exercising Shareholder Rights,” represents the latest in what has become a political battle regarding how retirement plan fiduciaries may consider ESG factors as part of their investment decision-making process.

In short, the new rule is more supportive of investment managers’ consideration of ESG factors in retirement and pension plans regulated by the federal government.

While the rule does not “require” consideration of ESG factors when considering investment options, it represents a significant change from the prior DOL approach. Previously, there appeared to be a heavier burden placed on plan fiduciaries’ consideration of ESG factors.

Given this shift in approach and the accompanying controversy among policymakers, it might be helpful to start with a basic understanding of what ESG means to those of us outside the D.C. bubble.

WHAT IS SUSTAINABLE INVESTING?

Sustainable investing can mean different things to different people. Adding to the confusion is the list of terms often used interchangeably, including ESG investing, impact investing, and socially responsible investing (SRI). Stated very broadly, sustainable investing is an investment strategy that meets the following four criteria:

Allows investors to put their money to work consistent with their values

Aims to provide better outcomes for society

Includes a focus on environmental, social, and

governance (ESG) factors

Complements traditional investment analysis and objectives

Sustainable investing goes beyond merely avoiding investments with meaningful exposure to industries that may be deemed harmful to society, like alcohol, firearms, fossil fuel production, gambling, and tobacco. It also looks to emphasize or enhance exposure to elements with a positive societal impact. All of this is done through a focus on various ESG factors.

WHAT ARE ESG FACTORS?

ESG factors are criteria that investors focused on sustainability consider when evaluating potential companies for investment. These factors include a company’s actions, beliefs, and policies toward various environmental, social, and corporate governance issues.

Exhibit 1 shows an incomplete list of various ESG factors and issues commonly considered by investment managers:

Exibit 1 | Source: Clayton Wealth Partners (CWP).

The more favorable a company’s approach to these factors in terms of benefits to society, the more sustainable the company is considered. Note that ESG investing considers the well-being of several important constituents beyond the traditional analysis of shareholders or other investment owners.

SUSTAINABLE INVESTING IS GROWING IN POPULARITY

We’ve seen an increase in recent years in the interest and employment of ESG investing. Exhibit 2 highlights the growth in interest among nonprofessional individual investors in sustainable investing by age. Interest is greatest among younger investors, which may be of little surprise. But a bit more surprising is that now more than half of all older adult retail investors are interested in ESG strategies.

Exibit 2 | Source: CFA Institute, CWP.

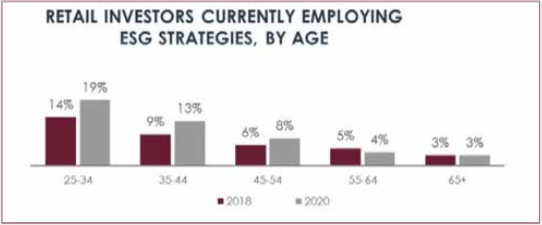

And investors are acting on their interests. Exhibit 3 shows the growth among retail investors that are employing sustainable investing strategies, again by age.

Exibit 3 | Source: CFA Institute, CWP.

Exibit 4 | Source: Morningstar, CWP.

This strong growth in the pursuit of values-based investing is showing up in other data. Exhibit 4 depicts the increase in sustainable assets under management. Given the recent changes in the DOL’s rule regarding ESG considerations, one can expect this number to grow in large pension and retirement funds. To be sure, some of the growth can be attributable to strong gains in the stock market overall over the past few years. (A chart produced following the 2022 bear market will produce numbers that look quite different from the relative success produced by ESG investing in the recent past.) But Exhibit 4 also shows the parabolic rise in net flows, or net cash that investors put into ESG strategies. Long-term drivers of this trend include powerful demographic trends together with government policies favorable to ESG investments.

Given the DOL’s shift regarding ESG considerations, there is little doubt that ESG will be a topic for investors in the immediate future. With the rise in demand for sustainable investing, investors should be able to match their investment strategy with their values. Whether that includes strong belief in the importance of ESG considerations or the more traditional risk verses reward strategy, it’s important to be educated on where your dollars are being invested.